A frequent question in estate planning is: Should I have a will or a trust? To answer that question, we need to first understand what is a will, what is a trust, and what are their legal functions. Both legal documents play critical roles in estate planning and can be used jointly to maximize planning. For most clients it is worth the time and costs to take the additional steps to set up a trust because of the added privacy, control, and probate avoidance. So, let’s start by first discussing each document separately.

What is a Will?

A will, also referred to as a last will and testament, is a legal document that enables a person to specify how their assets are to be distributed upon their death. In this document you will appoint an executor who will handle the distributions. If you have children that are minors, a will allows you to name a legal guardian to care for those children. For a will to be valid in most states the following must occur:

- The testator (person making the will) must be at least 18 years of age.

- The testator must be of sound mind when signing the will.

- The will must be in writing.

- The testator must sign the will in the presence of at least two witnesses who will attest to the testator signing the will.

There is no requirement to have the will notarized. But if you choose to have your will notarized, then it will be considered a self-proving will. In this scenario, the testator and the witnesses will need to visit the notary together and sign an affidavit. When the testator and witnesses sign the will in front of a notary, that will becomes a self-proving will. A self-proving will effectively confirms that the will was executed properly and eliminates the need for the probate court to contact the witnesses to verify their signatures. Although getting a self-proving will sounds like a great idea, asking your witness to accompany you to a notary can often prove difficult. That is why many clients skip the step of establishing a self-proving will.

A will can be changed or revoked at any time. If you choose to change your will you can add what is called a codicil, which contains the new terms of the will. You can think of it similar to an amendment. Whereas a revocation of your will invalidates the document in its entirety.

What is a Revocable Trust?

A trust can take many forms. However, typically when most people think about setting up a trust they are referring to a revocable trust (sometimes referred to as a living trust). A revocable trust is a legal document that allows the settlor (the person establishing the trust and likely donor of assets) to transfer ownership of said assets into a trust (a legal entity). The trust is “revocable” because legal document gives the settlor the power to revoke or amend the trust. The trust assets will be managed by a trustee according to the written instructions contained in trust document. The process of transferring asset ownership into a trust is often referred to as funding the trust. During the settlor’s life, the settlor is typically named as the trustee. Upon the settlor’s death, at least one 3rd party must be named as the successor trustee. Usually at that point the once revocable trust, becomes irrevocable (meaning the trust document is no longer subject to revocation or amendment) and the successor trustee will be charged with managing and distributing the assets according to the instructions outlined in the trust.

What Are the Similarities and Differences Between a Will and a Trust?

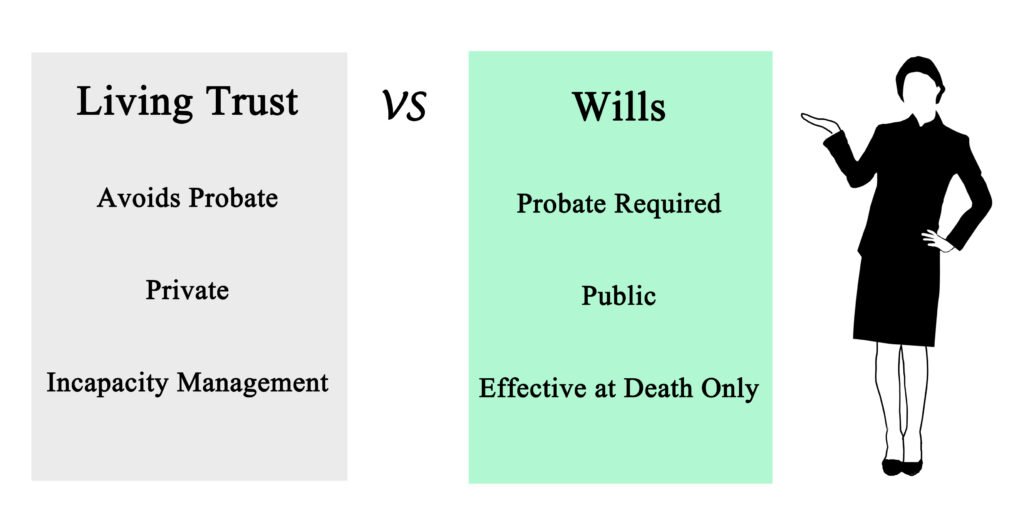

Both legal documents are used to transfer a person’s assets upon their death to beneficiaries. The distribution of said assets will be in accordance to the specific gifts, percentages, or conditions specified in the legal documents. Another similarity is that both a will and a revocable trust can be changed or revoked during the testator/settlor’s life.

One difference is that a will becomes a public document after the death of the testator because it must be filed with the Probate Court. Whereas a trust is not required to be filed with a Probate Court and can remain private unless it is involved in litigation. Therefore, if a person is weary of prying eyes or jealous family members not named as beneficiaries under the trust, then a trust is a better option to secure your privacy.

Another difference is that the property controlled by a will must go through the probate process under the oversight of the state court. Depending on your state, the average time frame for probate can be short (3 to 6 months) or lengthy (12 to 18 months). The complexity of the estate in question will also factor into how long it will take to probate the estate. Probate is a process where the court oversees the administration of the estate by the executor to ensure debts are paid and the remaining assets go to the beneficiaries. Probate is a more expensive process because of court costs and attorney fees. Additionally, there is less flexibility for the executor because the estate assets are tied up during the probate process. Whereas, a trust will go through the trust administration process and administered by the selected successor trustee(s). During trust administration the successor trustee has full control and increased flexibility over the assets. The trustee is responsible for paying off the debts of the estate and either managing or dispersing the assets to the beneficiaries. Although there will still be court costs and attorney’s fees involved with trust administration, it should be significantly less expensive than going through probate with only a will.

A Trust Is Superior To A Will For Asset Management When You Are Gone

A trust is superior for controlling assets after you pass away. Such as allowing a trustee to hold and manage assets for beneficiaries who are minors and then distribute those assets free and clear when the beneficiaries reach a certain age or milestones. A trust can be established where it breaks into subtrusts that will be independently managed for each individual beneficiary or it can create a pot trust that will be shared jointly by all beneficiaries. A trust can be set up to add special provisions such as protection for a child with special needs or a child who is a spendthrift. None of these options are available with a last will and testament because a will generally distributes assets instead of manages assets. Another good example is that a trust can establish an irrevocable subtrust upon the death of one spouse. This may be useful in blended family situations. In this situation a settlor trustee may want to ensure that their separate property assets are solely distributed to their biological descendants and not their current spouse or stepchildren.

If you own real estate in multiple states a revocable trust is far superior than a will. As stated earlier, assets controlled by a will must go through the probate process. A probate court only has authority over property located in its own state. Thus, if you have real estate in multiple states, your executor may have to travel to each state where property is located and go through an ancillary probate process. On the other hand, every state recognizes the validity of a trust properly established in another state. As long as the settlor trustee funded the real estate in to the trust, in accordance with the rules and regulations of the state where the property is located, then that property can bypass probate and be administer by the successor trustee in accordance with the trust document. This should result in a significant savings in court cost, attorney fees, and travel expenses to the estate.

As you can see from above, both a will and a trust are better than dying intestate (without a will). But the control and flexibility provided to you with a revocable trust is superior and well worth the additional costs and time to set up.

Using Both a Last Will & Testament & Revocable Trust

One thing of note, in circumstances where you establish a revocable trust you are still in need of a will. But in this situation, you want to establish a pour-over will. A pour-over will is a compliment to your trust. In a pour-over will you can still nominate a guardian over your minor children and you can leave specific gifts to beneficiaries. The most important aspect to a pour-over will is you instruct your executor to fund any assets that were not funded into your trust during your life into your trust at the time of your passing.

Understanding the differences between a will and a trust is crucial for effective estate planning. If you have any questions or concerns about your own estate plan, don’t hesitate to reach out to us by clicking on the contact us button on the website and send us a message with your contact info.